Explore a diverse range of resources designed to empower businesses, enhance strategies, and foster growth.

Our Resource Guides are carefully crafted to provide you with in-depth insights, step-by-step instructions, and practical tips for effectively managing chargebacks. Whether you’re a business owner, a financial professional, or a chargeback management enthusiast, our guides offer a comprehensive understanding of the intricacies involved. From chargeback prevention strategies to dispute resolution tactics, our Resource Guides are your roadmap to achieving excellence in chargeback management. Explore our collection to unlock valuable expertise and empower your business for success.

Welcome to our Events page, where we bring you opportunities to engage, learn, and connect with industry experts and like-minded professionals in the realm of chargeback management. Stay updated on upcoming webinars, workshops, seminars, and conferences that cover a wide range of topics, from the latest trends in dispute resolution to innovative strategies for preventing chargebacks. Join us in these events to expand your knowledge, network with peers, and stay at the forefront of chargeback management advancements.

In the world of chargebacks, understanding the reasons behind disputes is crucial for efficient resolution. Our Chargeback Reason Codes section provides you with a comprehensive breakdown of the various codes used by card networks to categorize chargeback cases.

Whether it’s unauthorized transactions, goods not received, or other common chargeback scenarios, our detailed explanations empower you with the knowledge needed to address disputes accurately and effectively. Explore our Chargeback Reason Codes resources to enhance your dispute resolution strategies and successfully navigate the complexities of chargebacks.

Our Payment Industry Glossary, where we unravel the terminology and jargon that shape the world of financial transactions and chargeback management. Whether you’re a seasoned professional or new to the industry, our glossary offers clear and concise explanations of key terms, concepts, and acronyms.

From ACH to EMV, from card networks to encryption, our glossary serves as your guide to navigating the intricate landscape of payment processing.

A chargeback is a dispute initiated by a customer with their bank, resulting in the reversal of a transaction’s funds. It’s typically used for cases of unauthorized transactions, fraud, goods not received, or dissatisfactory products/services.

Chargebacks can lead to financial losses, increased processing fees, damage to your reputation, and potential restrictions from payment processors.

A refund is initiated by the merchant, where the customer receives their money back directly from the business. A chargeback is initiated by the customer’s bank, involving the reversal of funds from the merchant’s account.

Chargeback prevention involves providing clear product descriptions, excellent customer service, accurate billing, secure payment processing, and efficient dispute resolution.

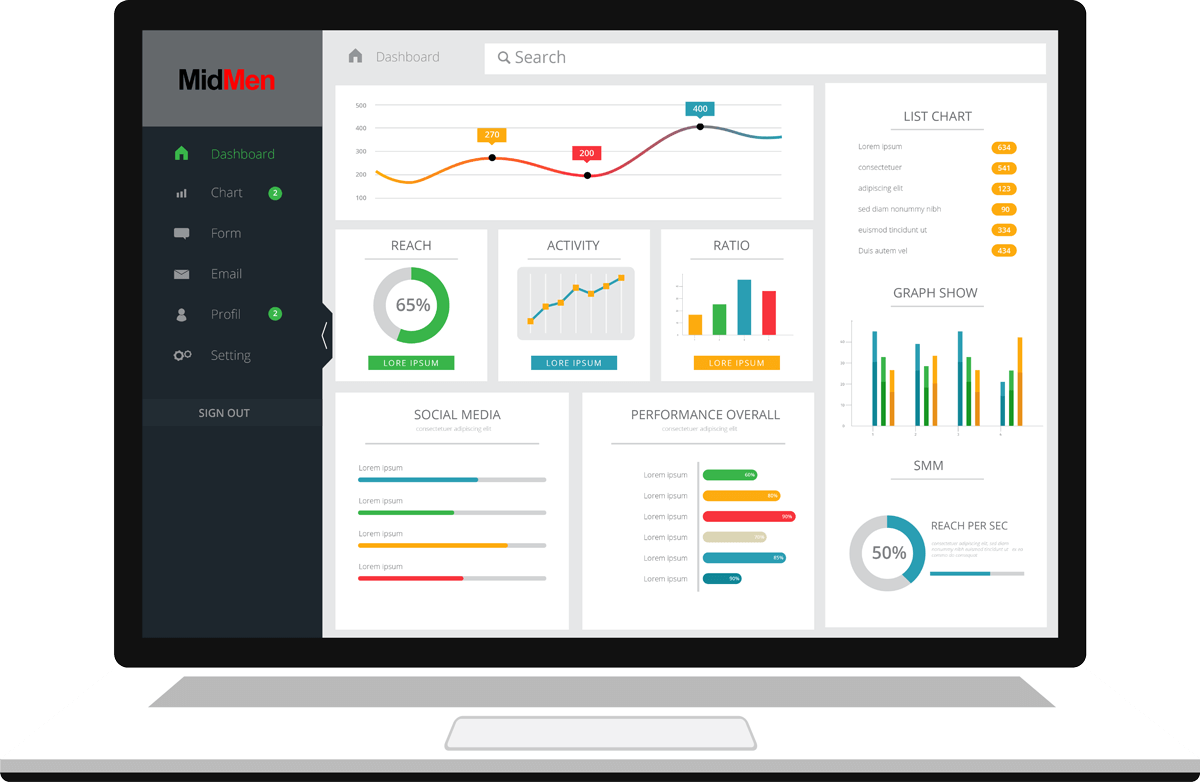

Chargeback management software helps businesses track and manage chargeback cases, gather evidence, streamline responses, and gain insights into chargeback trends to minimize losses.

Through continuous innovation, education, and collaboration, we strive to be the foundation upon which our clients build stronger, more resilient businesses.